Landlord's House Insurance

TapiA few years after we introduced Tapi’s property care platform into the NZ and AU markets, we had become a major b2b PropTech provider. We set out to identify more areas in and around rental properties causing friction for users, while targeting our business goal of increasing revenue per property.

Read on to learn why landlord insurance became an obvious choice.

Understanding insurance pain points

When we conducted interviews with landlords, property managers, and agency CEOs to learn about their experiences with landlord insurance, we quickly uncovered a few significant pain points:

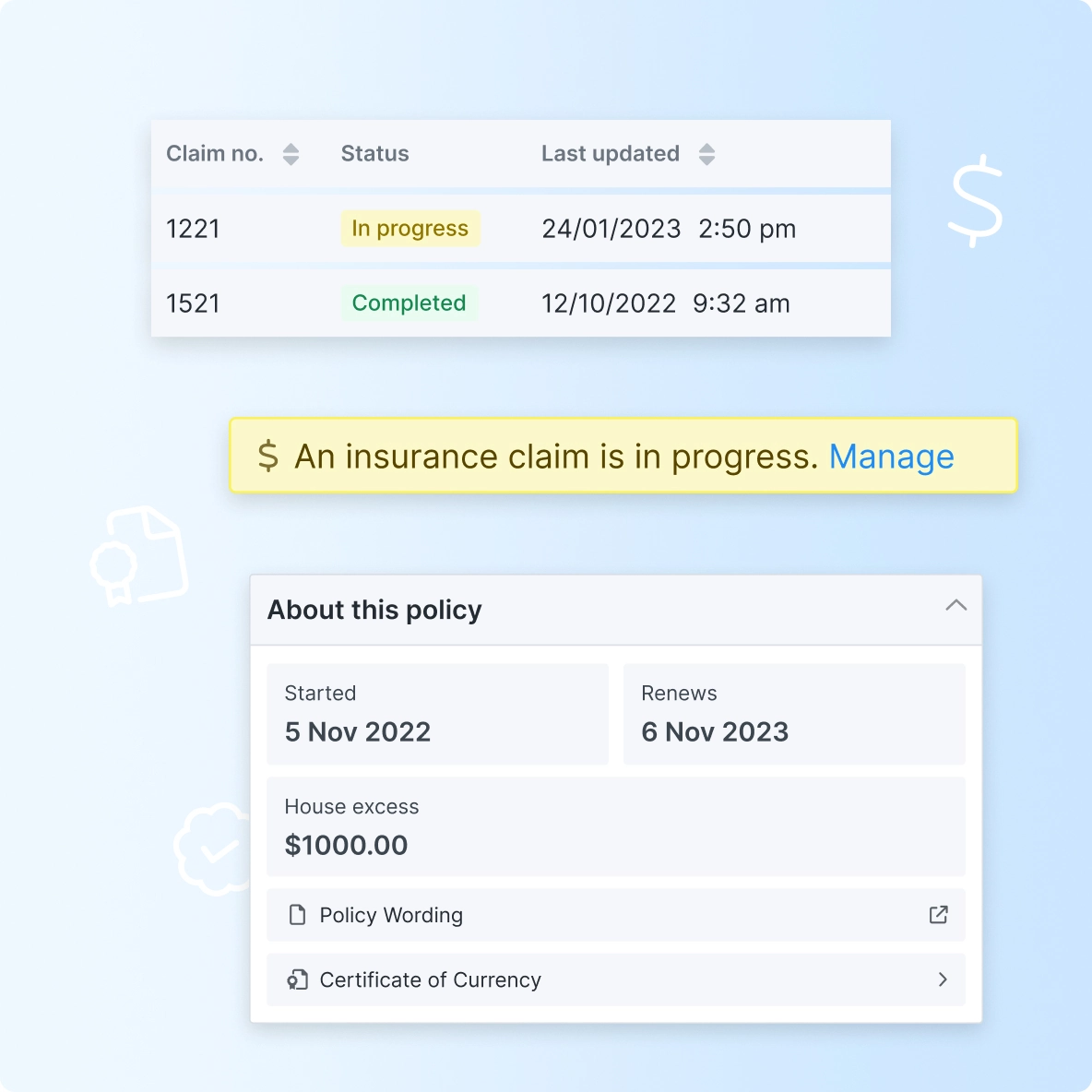

- Peace of mind was disrupted for landlords due to the active management of insurance claims.

- Property managers had an increased workload coordinating between landlords and tenants.

- Delayed repairs were impacting tenant satisfaction and retention.

Current products were flawed because they were in no way integrated into the property managers’ processes, solely relying on landlords to handle the communication with their insurer.

Toolbelt

-

Market Analysis

Product vision

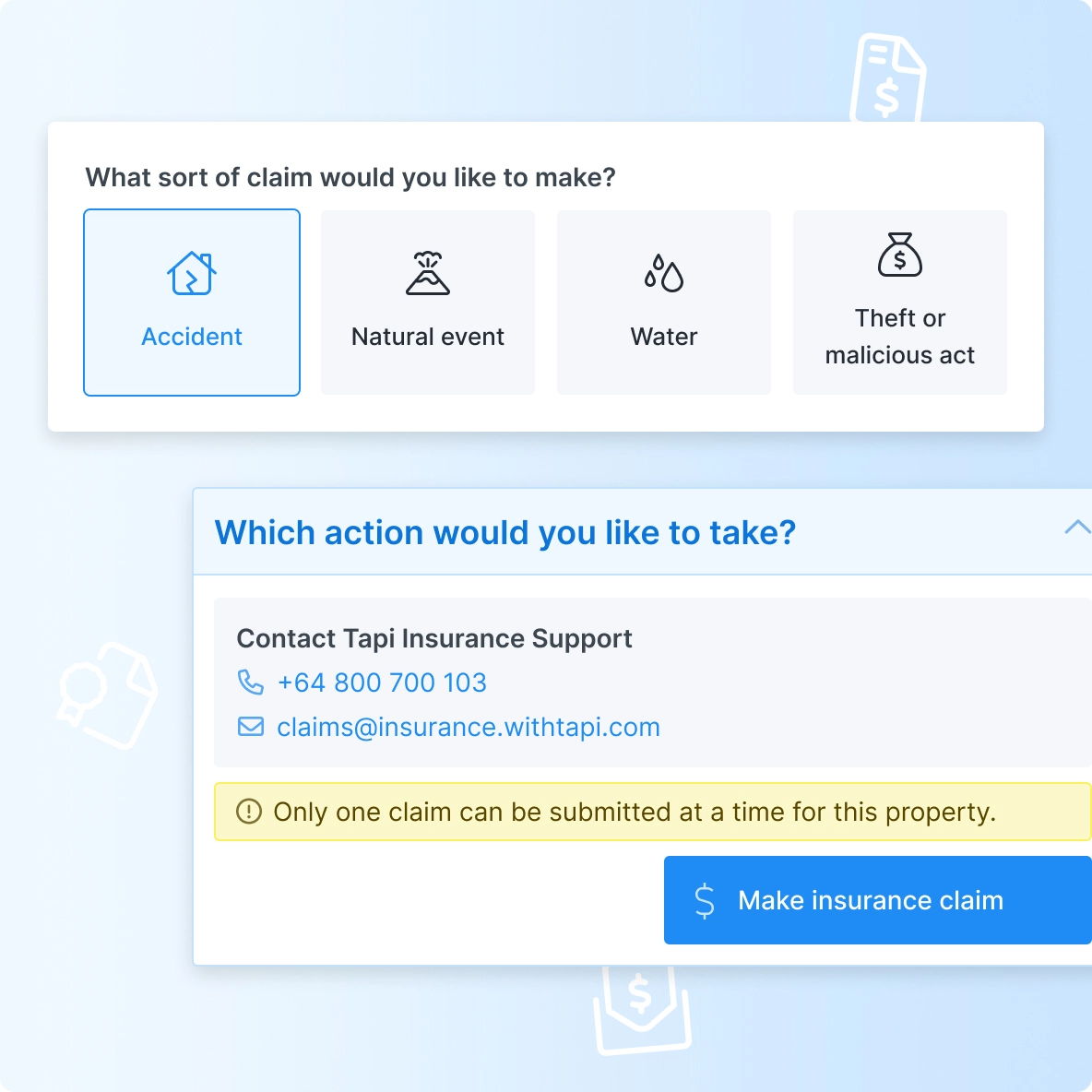

Our goal was to design a modern landlord insurance product that:

- Saves landlords time through transparent processes.

- Empowers property managers to efficiently manage claims.

- Increases revenue for property management agencies.

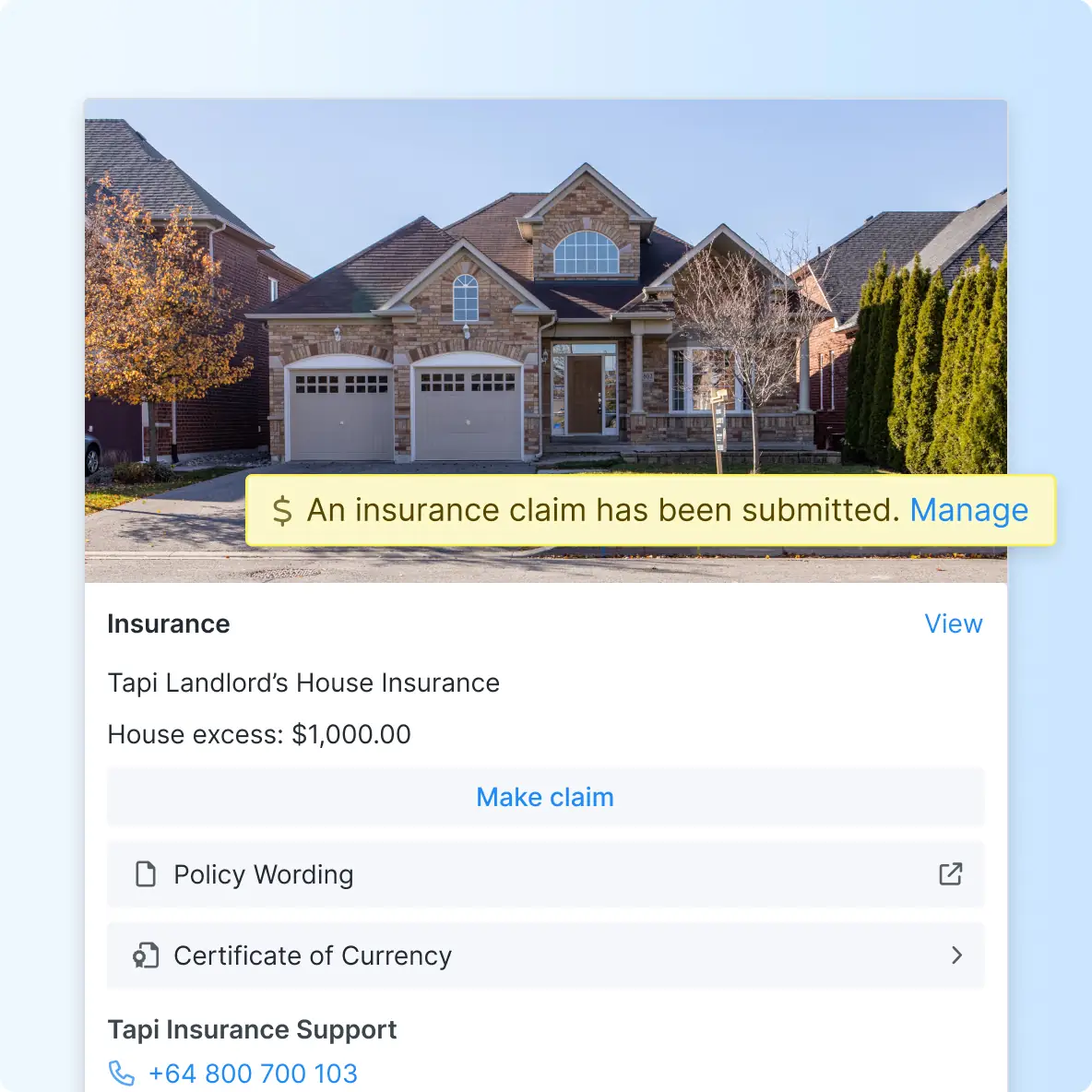

- Speeds up repairs for tenant satisfaction.

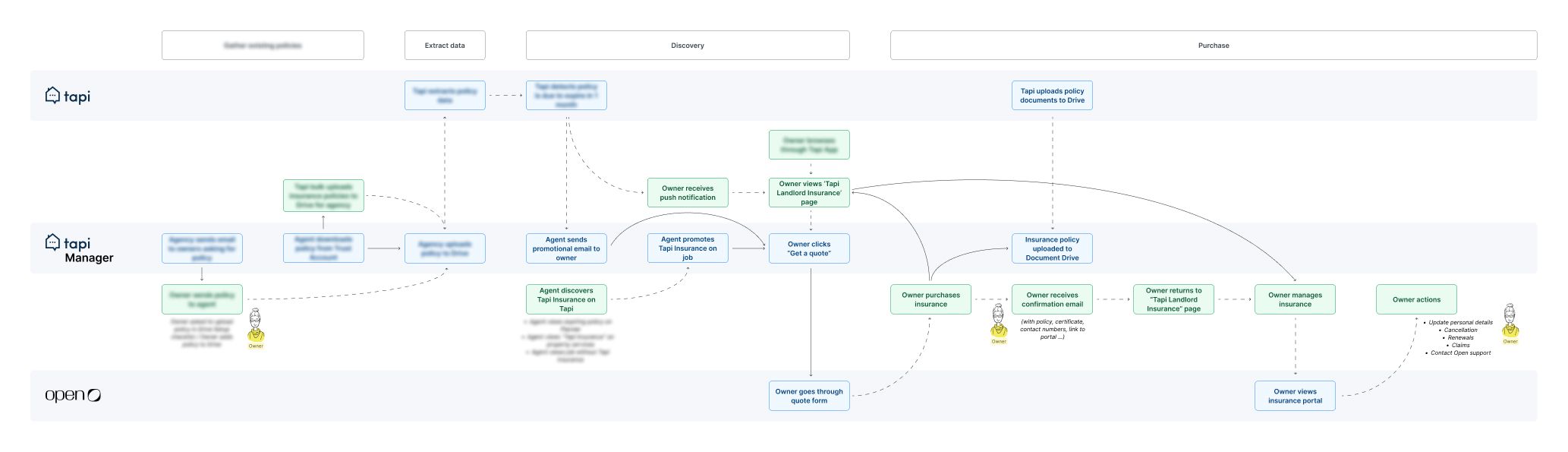

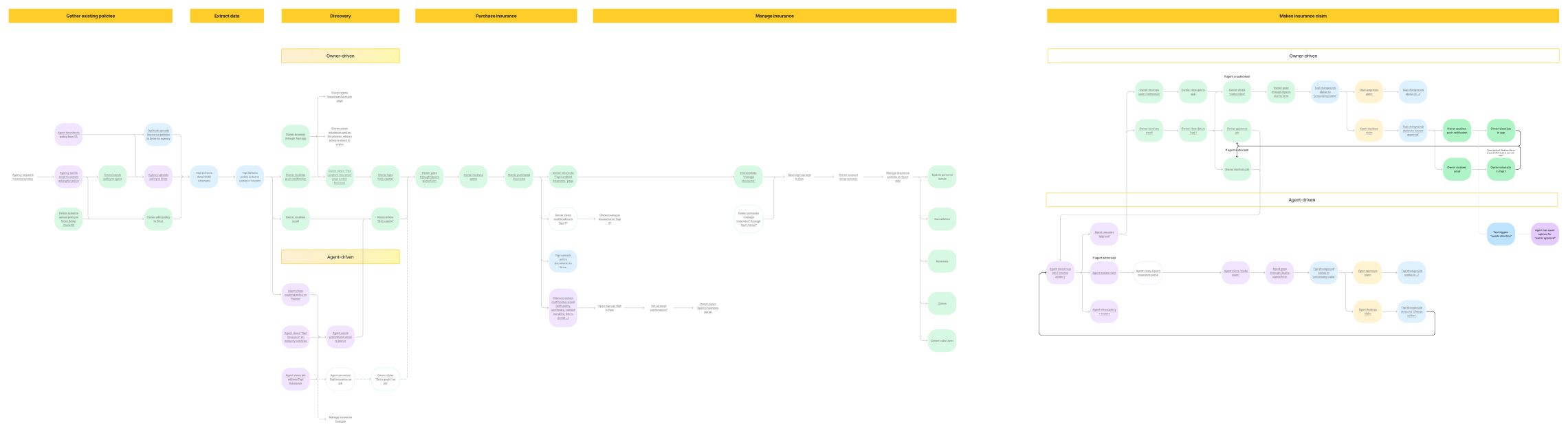

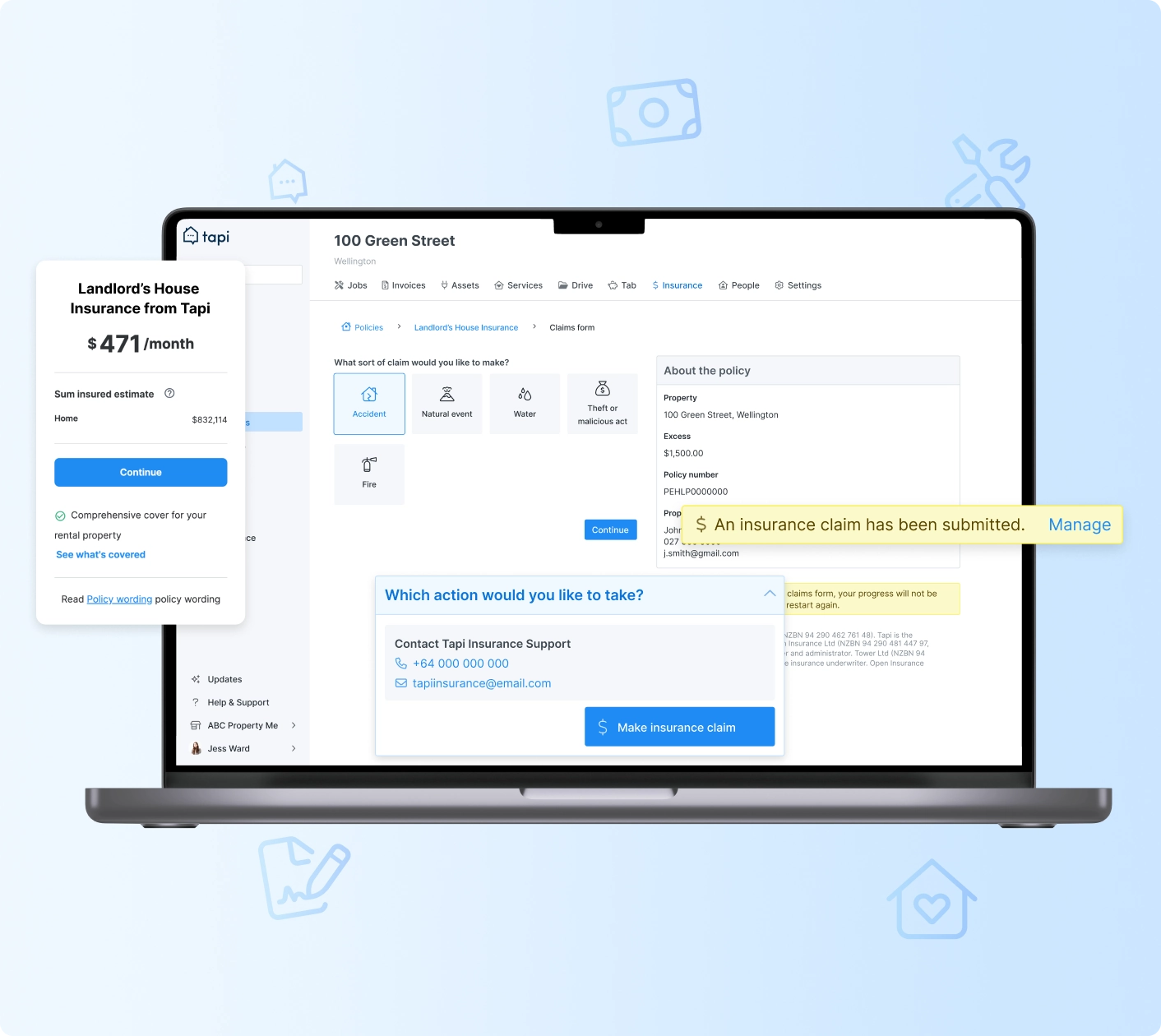

We planned to achieve this by tightly integrating the insurance process into Tapi’s existing platform and partnering with Open Insurance to utilise their infrastructure for policy management and claims processing.

Toolbelt

Research and early design

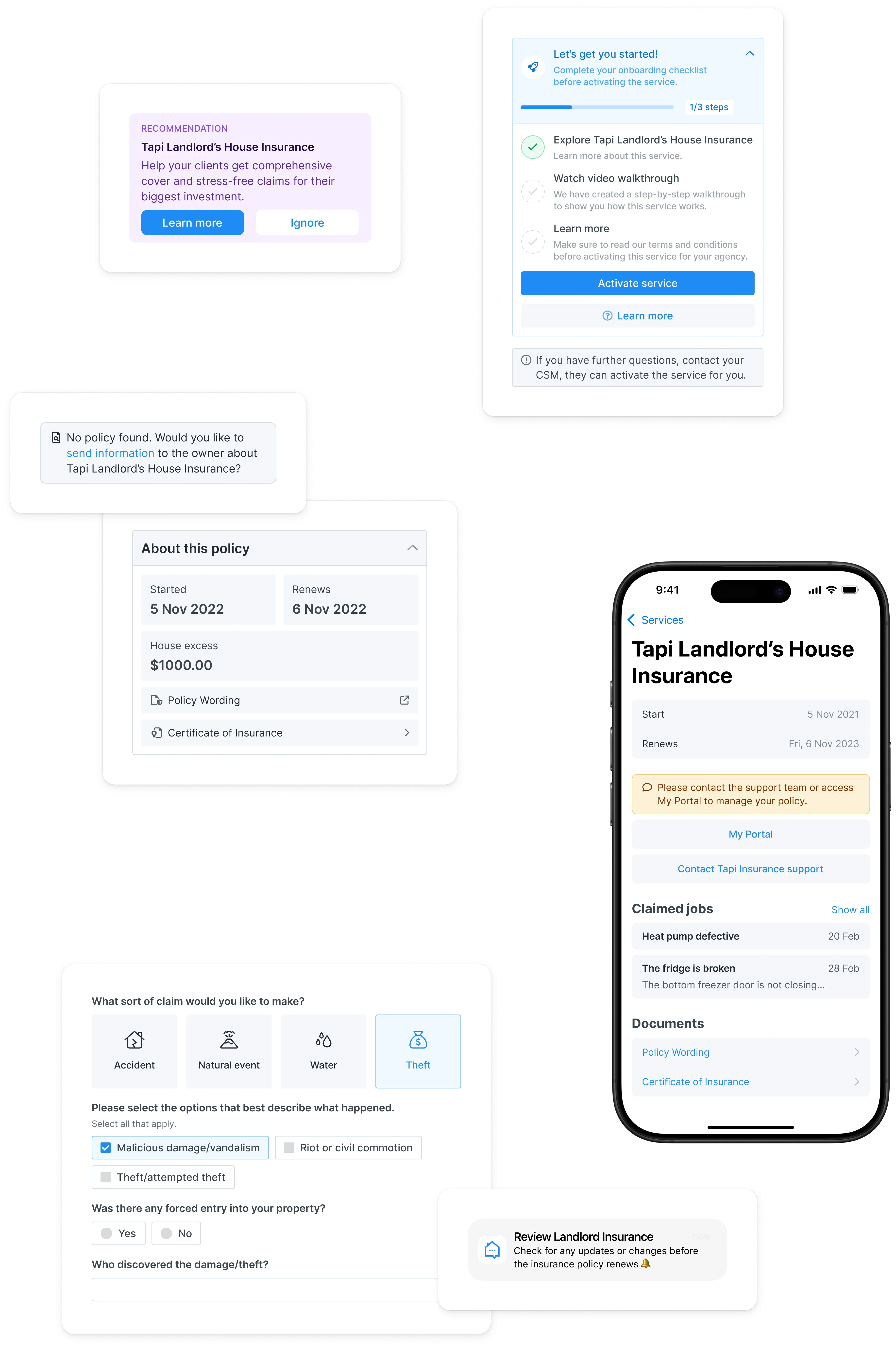

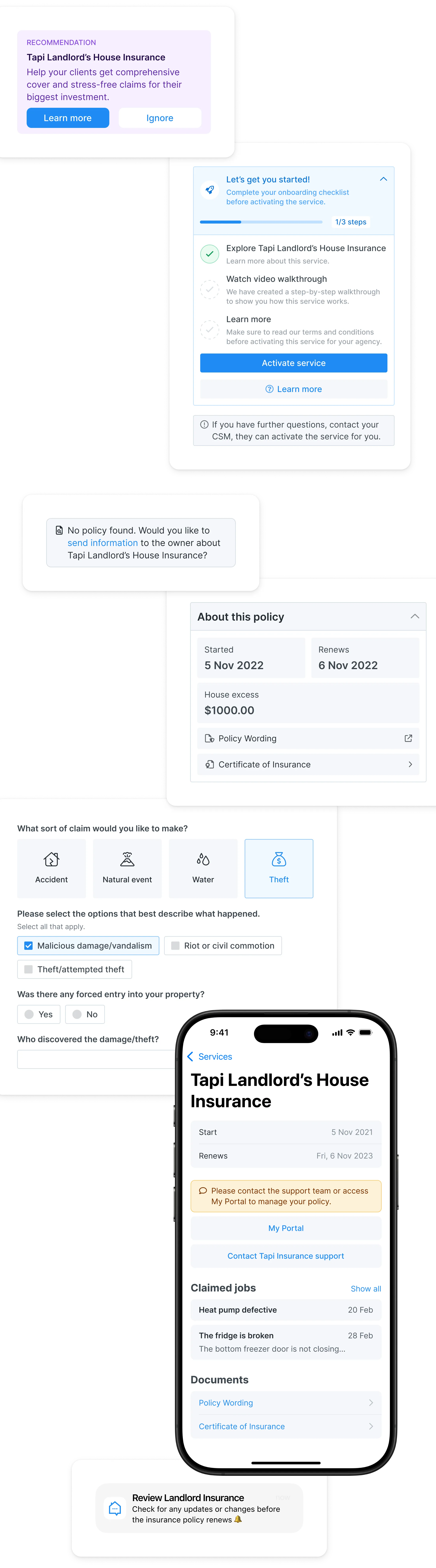

Our collaboration with Open Insurance was a significant advantage during the research and early design phases. They had already simplified the sign-up process and policy management, providing us with forms and a portal that we could integrate into our platform.

Our primary challenge was to seamlessly fit the insurance process into our existing maintenance workflow, ensuring that property managers could handle insurance claims for landlords without significantly increasing their workload. This level of deep integration into another system was new for Open Insurance as well, requiring close collaboration.

Our process involved:

- Brainstorming sessions and customer journey mapping to visualise solutions.

- Developing low-fidelity wireframes to outline new user flows and gather stakeholder feedback.

- Iterating to high-fidelity prototypes tested with a small group of landlords.

Toolbelt

Content design

Content design was a particularly interesting challenge, given Tapi’s focus on making complex processes accessible and easy to understand. Meanwhile, the insurance product required clear language that was legally sound and compliant with insurance regulations.

To bring these two worlds together, we shared our Figma prototypes with Open Insurance’s legal team, allowing for asynchronous collaboration. This approach ensured that our content was both user-friendly and legally compliant, protecting against potential liabilities while facilitating smooth and flexible communication between teams.

Iterative usability testing and legal compliance

We recruited current Tapi users—landlords and property managers—for both in-person and remote user tests of our Figma prototypes. This approach gave us a wide range of feedback, which was crucial in fine-tuning the product.

We prioritised feedback based on how feasible changes were, their impact on other stakeholders, and the overall significance of the issues. This showed our knack for balancing resources and user needs to create a well-rounded and practical solution.

Alongside user testing, we worked closely with our partner Open Insurance, going through several rounds of legal oversight to make sure we met insurance regulations. This impacted our content design, leading us to tweak wording across the product. These changes ensured our communication was legally sound, protecting against potential liabilities.

Smooth soft launch

The product was rolled out with a soft launch, seamlessly integrating it into Tapi’s existing platform. The initial reception was positive, highlighting the effectiveness of our user-focused design and collaborative efforts. This project demonstrated our commitment to creating impactful and user-friendly solutions in the rental property market.

A Rare Case of Win-Win-Win-Win-Win 😅

Tapi’s unique 4-stakeholder platform Property managers, tenants, landlords and trade contractors use Tapi's platforms to collaborate and communicate. inherently brings complexity to building new features and services but also offers the potential for significant market impact. In the case of Landlord’s House Insurance, not only did Tapi’s four user groups benefit, but the advantages extended beyond:

- Technology partner Open Insurance and their underwriter benefited from expanded business opportunities.

- Property management agencies saw additional revenue through commission.

- Tapi strengthened its market position and service offerings.

Moreover, the insurer benefited by passing small repair jobs to property managers, thereby reducing their operational costs. This project exemplified a win-win-win-win-win scenario, showcasing the broad and positive impact of our integrated design and collaboration efforts.

Explore next:

Property Tab